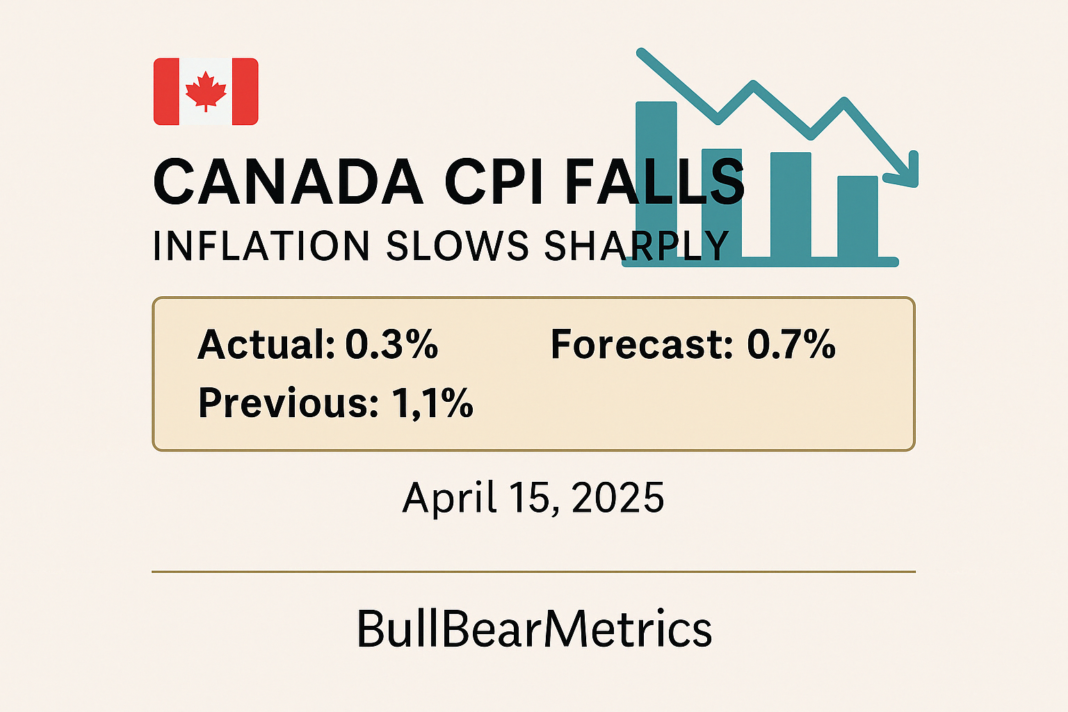

Date Released: April 15, 2025

Currency: CAD

Indicator: Consumer Price Index (Month-over-Month)

- Actual: 0.3%

- Forecast: 0.7%

- Previous: 1.1%

- Impact Level: High

Summary

Canada’s Consumer Price Index (CPI) data for April showed a significant deceleration, coming in at 0.3%, well below both the forecast of 0.7% and the previous month’s reading of 1.1%. This release indicates a notable softening of inflationary pressures.

Economic Insight

- The sharp drop in CPI suggests waning consumer demand or easing energy/commodity prices.

- Lower inflation may give the Bank of Canada room to pause or reconsider future rate hikes.

- A continued downtrend in CPI could push monetary policy in a more dovish direction.

Broader Implications

- Investor Confidence: May reduce CAD demand short term.

- Bond Markets: Yields could fall in anticipation of slower tightening.

- Currency Impact: The Canadian Dollar may weaken as rate expectations ease.

Market Reaction (Update Later)

Bottom Line

- CPI missed expectations significantly

- Market likely to reassess CAD strength

- Await further data before pricing major policy shifts

![Weekly Recap: GBPCHF & NZDCHF Trades – [Week Ending: April 21-25, 2025]](https://bullbearmetrics.com/wp-content/uploads/2025/04/WhatsApp-Image-2025-04-14-at-20.17.34_7fd1cbf9.jpg)