When traders talk about forex, conversations usually revolve around candlestick patterns, support/resistance zones, or moving averages. While technical analysis is essential, it’s only half the story. The other half — the one that actually moves the markets — is fundamental analysis.

What Is Fundamental Analysis, Really?

Fundamental analysis looks at the economic health and policy decisions of a country to determine the long-term strength or weakness of its currency. Think:

- Central bank interest rates

- Inflation trends (CPI, PPI, Core CPI)

- Employment data

- GDP growth

- Political stability

- Trade balances

In short: fundamental analysis helps you understand why a currency is moving — and whether that move is sustainable.

Why Swing and Position Traders Can’t Ignore It

Unlike scalpers or day traders who focus on micro movements, swing and position traders rely on larger, more stable trends. These trends are almost always driven by fundamental shifts in the economy.

Examples:

- A central bank hinting at future rate hikes → bullish for that currency

- Rising inflation without policy tightening → bearish sentiment

- Weak employment data → long-term currency weakness

Understanding these patterns helps you stay in trades longer, avoid false breakouts, and align with the true market direction.

What Happens When You Trade Without Fundamentals?

- You enter trades too early or too late

- You rely only on chart patterns without knowing why they form

- You get caught in consolidations and fakeouts

- You miss major moves triggered by news you didn’t prepare for

In the long run, this leads to inconsistent results and emotional trading.

The Long-Term Benefits of Trading with Fundamentals

✅ Better Timing – You’re more likely to enter before the big move, not after it.

✅ Stronger Trade Conviction – No second-guessing when you know the fundamentals support your direction.

✅ Confidence to Hold – Position traders especially benefit from the clarity of macroeconomic trends.

✅ Improved Risk Management – You avoid trades that contradict broader economic sentiment.

How to Start Applying It (Even Without a Finance Degree)

You don’t need to be an economist to understand fundamental analysis. You just need:

- A clear dashboard that shows economic events and their potential impact

- Tools that help you track currency strength based on real data

- A simplified breakdown of news, categorized by importance and country

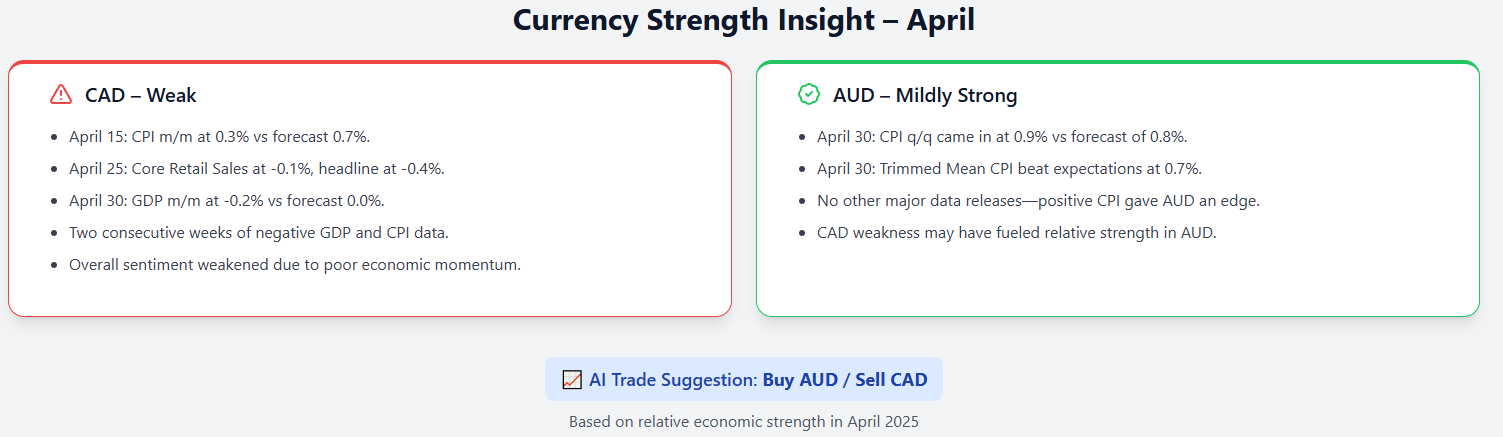

- Pair-matching insights (e.g., weak CAD vs strong AUD)

Final Thoughts

Technical analysis shows you where price might go.

Fundamental analysis tells you why it’s going there — and whether it will stay.

If you’re a swing or position trader looking for more consistency and fewer surprises, incorporating fundamental analysis into your process is not optional — it’s essential.

Ready to explore the power of fundamentals? [Follow us on Twitter and be in the know when we launch